Financial Report

Preface

The economic and political crisis continues to plague our country with no end in sight. AY2020-2021 witnessed an accelerated corrosion of the economic situation. Unemployment, inflation, poverty, and social unrest continue to rise and have reached unprecedented heights and depths, while the government is stranded and helpless.

Add to that the amplification of the banking and liquidity crises which have limited, to a greater extent, access to hard, and even local, cash currencies. Though several companies are trying to contain the storm by adapting to the evolving situation, several projects have been put on hold, and signs of business cessations, along with large-scale dismissals of employees and labor are still showing, thus sadly increasing the overall chaos.

The lifting of the subsidy by the Central Bank of Lebanon (BDL) has adversely impacted the purchasing power of a large portion of the Lebanese population. As of January 2022, the rate of inflation has soared to an unprecedented 992 percent coupled with a 1,400 percent reduction in the value of the national currency. The gap reflects the consumption parity effect where prices of many consumer products were adjusted to offset a decreased demand thereof.

Businesses in Lebanon are rapidly conforming to the prevailing conditions by adopting almost full dollarization of the cost of products. At present, the “Sayarafa” rate (the exchange rate adopted by the BDL) of LBP 20,500/$1 has become the reference for most of the transactions taking place in US dollar.

Amidst this turmoil, the university, like other higher education institutions, has been severely impacted by the depression. Drastic measures were considered to partially rebalance its financial position in order to maintain a minimum level of self-sustainability. These measures consisted of applying a revised rate of exchange to tuition coupled with a significant adjustment to financial aid making sure that a significant category of students - especially those underserved - is not affected. A budget reduction of 11 percent was implemented and, like last year, a cost containment program was diligently devised and applied while ensuring quality is not in any way compromised.

Moreover, as part of its commitment to its community, the university has reinforced its relief package for its staff and faculty. Higher percentages of hard currencies were introduced, and transportation and schooling reimbursement rates were significantly increased to cope with the astronomical hike in prices. All of this was made possible through a substantial reliance on the LAU endowment portfolio.

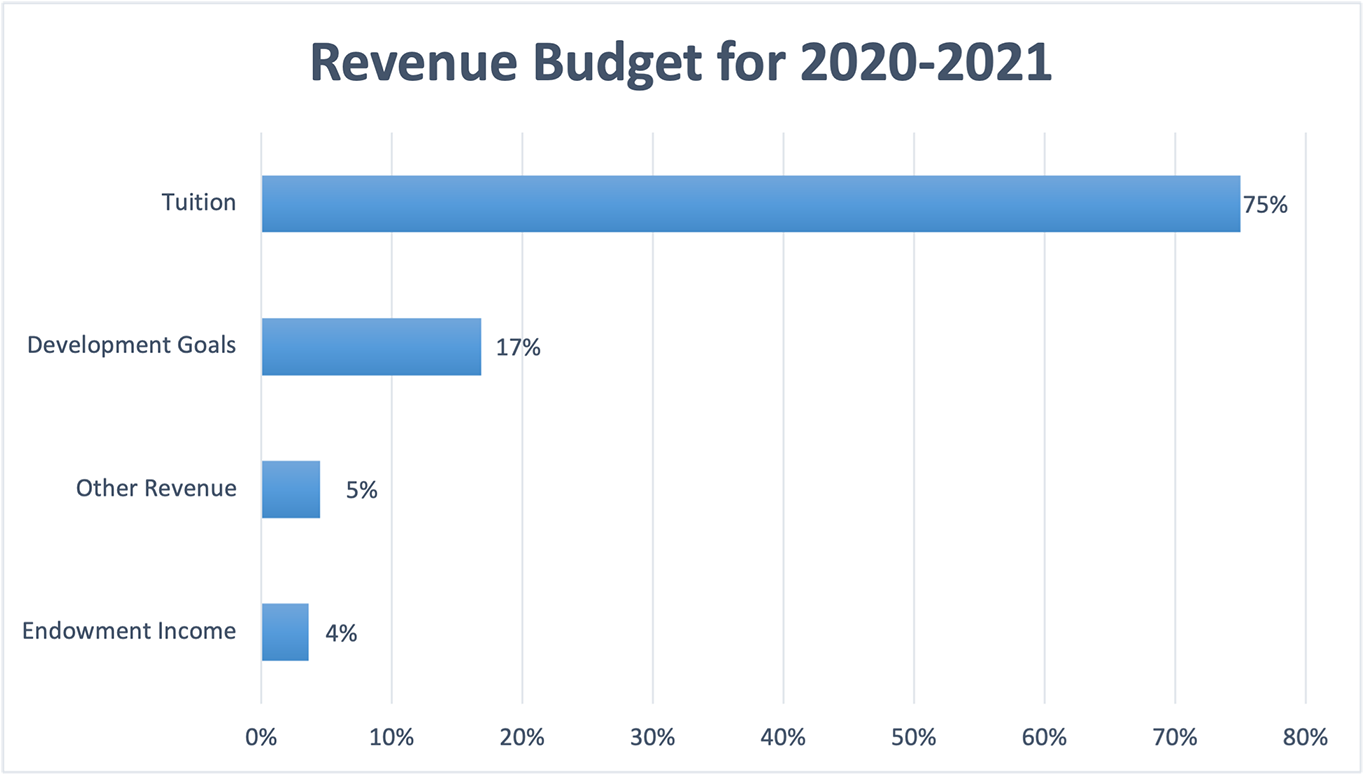

The university is still heavily dependent on tuition as a main source of revenue. LAU started to charge the tuition at the rate of LBP 3,900, as opposed to LBP 1,500 in AY2019-2020, thus applying a 260 percent increase on last year’s tuition rates. Needless to say, this increase did not bring about the required funds to balance the university’s finances. In view of the fact that the fair market value of this main source is considerably less than its nominal value, whereas the reverse is true for our spending, the mismatch between income and expenses was alarming. These facts have directed the university to seek new sources of hard currency mostly by venturing outside Lebanon for fundraising initiatives and enterprises in line with Pillar III of SPIII. Several attempts in this direction were explored and come into sight as very promising.

As an integral part of a complex national fabric, the university stood firmly by its mission to educate and serve, undertaking to help the students get an education irrespective of their financial means. This commitment was favorably perceived and welcomed by a community in desperate need of support.

LAU’s operating budget for AY2020-2021 was around $181.4 million, 11 percent less than the previous year. This decrease was a natural reaction given the restrictive and devastating economic conditions prevailing in Lebanon coupled with the direct impact of the lockdown.

The university has applied strict limitations to recruitment and restricted the hiring of new staff and faculty to strategically proven requests.

| Revenue Budget for 2020-2021 | US Dollars |

|---|---|

| Tuition |

136,084,18475% |

| Development Goals |

30,573,27917% |

| Other Revenue |

8,187,1625% |

| Endowment Income |

6,600,0004% |

| Total |

181,444,625 |

The Overall Picture

The university’s operational efficiency continued to contribute favorably to its financial stability. Total assets increased by $144.5 million, scoring a 13 percent growth. Net assets grew by approximately 16 percent, increasing its position to $1.23 billion on August 31, 2021.

On the operations side, enrollment was more or less the same as in AY2019-20, reflecting the impact of the deteriorating value of the currency. It is worth noting that the university continues to depend heavily on tuition revenues; 90 percent of our revenue stream is derived from tuition fees. This confirms the urgent need for revenue diversification such as increasing fundraising, tapping new markets, developing consulting services and corporate alliances, etc.

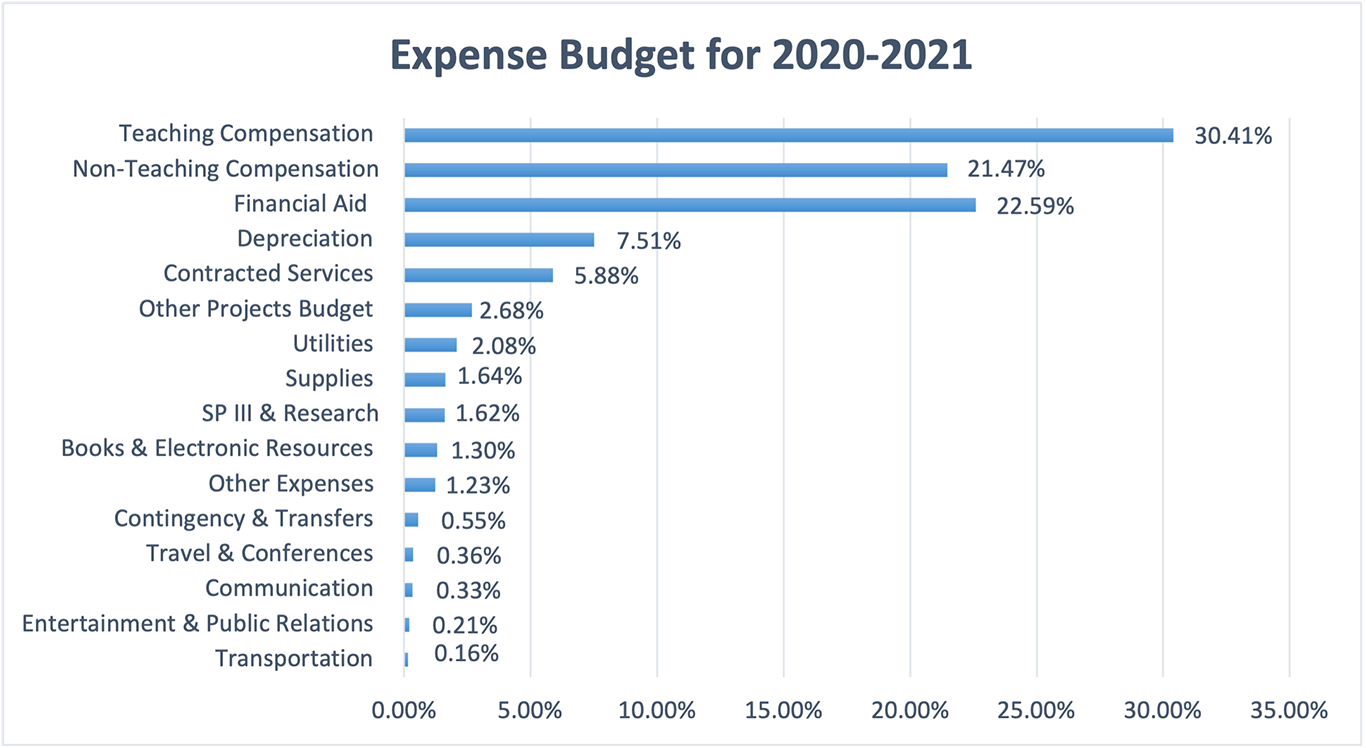

As part of LAU’s commitment to its students, undergraduate financial aid reached unprecedented heights during fiscal year 2020-2021. More 70 percent of undergraduate students benefit from financial aid. This number is expected to reach significantly higher levels during the next academic year in line with the new strategy adopted by the university and the fast-changing economic conditions.

During fiscal 2020-2021, LAU established a subsidiary named LAU Innovate SAL and subscribed in more than 99 percent of its share capital.

Investment in subsidiaries was $146.5 million. The cash injections into the hospitals were used to fund capital projects and certain operating activities, such as salaries and stockpiling of medical consumables. The fair market value of the property and assets of the hospital in Beirut returned a positive excess over the amounts already invested by the university, thus confirming that our investment in the hospitals is not impaired.

Total expenses, excluding financial aid, decreased by around 14.12 percent when compared to prior fiscal year in line with the university’s cost cutting plan. In addition to the above, operating expenses displayed continuing efficiency and effectiveness in the allocation of resources, sparing more funds for financial aid.

| Expense Budget for 2020-2021 | US Dollars |

|---|---|

| Teaching Compensation |

55,171,30030.41% |

| Non-Teaching Compensation |

38,951,26921.47% |

| Financial Aid |

40,989,10822.59% |

| Depreciation |

13,635,1677.51% |

| Contracted Services |

10,673,4635.88% |

| Other Projects Budget |

4,854,9792.68% |

| Utilities |

3,765,8302.08% |

| Supplies |

2,975,0421.64% |

| SP III & Research |

2,935,0001.62% |

| Books & Electronic Resources |

2,350,0321.30% |

| Other Expenses |

2,239,8901.23% |

| Contingency & Transfers |

1,000,0000.55% |

| Travel & Conferences |

650,8600.36% |

| Communication |

592,7200.33% |

| Entertainment & Public Relations |

373,1250.21% |

| Transportation |

286,8410.16% |

Endowment

Whether made monetarily or through assets, endowments provide the needed resources for future investing and expenditures for the university. Around the globe, universities like LAU rely on endowments to provide permanent self-sustaining sources of funding that foster dynamic and long-term stability from which the university can prosper.

Through such endowments, LAU has the capability to rely on a safety net for any unforeseen issues, as well as on extra resources to help provide constant support to critical areas of its development, such as scholarships and financial aid, campus expansions, and other various operational costs.

The importance of an endowment was acutely demonstrated during this past fiscal year that saw a number of unexpected events such as Lebanon’s ongoing crises, the COVID-19 pandemic, and the August 2020 explosion. These events, and their financial impact on the university, are precisely why the endowment exists, and what makes it an important area for constant funding.

At LAU, the endowment is divided into three different funds: general, schools, and financial aid. Within the region, students and their families are facing pressing economic challenges - meaning that financial aid is the most pertinent endowment at LAU that requires the most support. Those who donate to these funds make lasting impacts on the future of the university and provide positive opportunities for a countless number of students each year.

During fiscal year 2020-2021, LAU’s investment portfolio - which encompasses endowments -outperformed market indices. Looking ahead, some risks are expected to be well rewarded, and well-structured portfolios to achieve realistic investment goals.

To ensure a financially sound future for the university, the Office of Development continues to seek endowment gifts. In parallel, LAU’s Investment Committee, Investment Office and consultants continue to focus on winning strategies while monitoring the endowment portfolio, assessing market conditions, and building a strategic asset allocation mix and robust manager selection processes.