Financial Report

Operating Environment of the University

During the last quarter of 2019, Lebanon was encumbered by one of the worst political, economic and financial crises leading to a blatant recession, unprecedented inflation, a drought in foreign reserves, and an almost full collapse of the banking and public sectors.

The economy has been contracting at an accelerating pace since the last quarter of 2019, and the outbreak of coronavirus (COVID-19) affecting Lebanon and the whole world has contributed to further deterioration of the economic environment, disruption of businesses, and a rise in unemployment and poverty lines. The outbreak of COVID-19 started after December 31, 2019, and is adding up to the already adverse economic outlook.

Sovereign credit ratings have witnessed a series of downgrades by all major rating agencies and reached the level of default when, on March 7, 2020, the Lebanese Republic announced that it will withhold payment on the bonds due on March 9, 2020, which was followed by another announcement on March 23, 2020, for the discontinuation of payments on all of its US Dollar-denominated Eurobonds.

Throughout this sequence of events, the ability of the Lebanese government and the banking sector in Lebanon to borrow funds from international markets was significantly affected, reducing it to nil. Banks imposed unofficial capital controls, restricted transfers of foreign currencies outside Lebanon, and significantly reduced credit lines to companies and withdrawal of cash to private depositors, all of which added to the disruption of the country’s economic activity, as the economic model of Lebanon relies mainly on imports and consumption. Businesses are downsizing, closing or going bankrupt, and unemployment and poverty are rising fast and have reached unprecedented levels.

On April 30, 2020, the Council of Ministers approved the Lebanese government’s Financial Recovery Plan (the Plan). The Plan involves economic and fiscal reforms, reviewing the pegging policy, a comprehensive government debt restructuring, and a comprehensive restructuring of the financial system addressing accumulated FX mismatches, embedded losses, and resizing the banking sector.

On August 4, 2020, a devastating deadly blast occurred at the Beirut seaport causing severe property damages across a wide area of the capital along with a large number of casualties, aggravating the financial crisis prevalent in the country. On August 10, 2020, the Lebanese government resigned, and the Plan has not been implemented.

Effective 2021, the Central Bank started a gradual waiving of the various subsidies on essential products. In late 2022, all types of subsidies, mainly fuel and medication, ceased, resulting in a sharp surge in the prices coupled with a rapid deterioration in the Lebanese currency.

During the entire crisis and considering the classification of Lebanon as a hyperinflationary economy, a purchase power parity partially (PPP) factor emerged, contributing to a partial, yet important, counterbalancing of the inflation. It is important to note that the PPP was mainly bolstered by an overall drop in the consumption cost resulting from low public costs, a change in the standard of living, more reliance on cheaper local products, and devaluated individual income. With the escalated dollarization of the economy, the impact of the PPP started waning. This was mainly due to the slow but steady normalization of the purchasing power coupled with the impact of the public budget of the year 2022, released on November 15, 2022.

During the fiscal year ended August 31, 2021, the university’s operating activities contributed 3.3 percent to the increase in the net assets while non-operating activities contributed 96.7 percent. Lebanon has been witnessing, since the last quarter of 2019, severe events that have set off an interconnected fiscal, monetary, and economic crisis as well as a deep recession that has reached unprecedented levels.

By contrast, and with a further deterioration in the operating environment, fiscal year ended August 31, 2022, posted an unprecedented negative net assets movement of 8.7 percent, with a contribution mix of 42 percent and 58 percent from operating and non-operating activities, respectively.

The difficulty in accessing foreign currencies led to the emergence of a parallel market to the official peg whereby the price to access foreign currencies has been increasing constantly, deviating significantly from the official peg of 1,507.5 US$/LBP. This has resulted in an uncontrolled rise in prices and the incessant de facto depreciation of the Lebanese Pound, impacting intensely the purchasing power of the Lebanese citizens, driving a currency crisis, high inflation, and a rise in the consumer price index. Inflation increased at an accelerating pace, eroding the real value of the local currency and “local” foreign currency bank accounts and tossing Lebanon into hyperinflation and major economic collapse.

As a result of the unofficial capital controls, the multitude of exchange rates, hyperinflation and the potential repercussions of the government default, new terms were adopted in the Lebanese market, such as “Lollars” to designate local US Dollar bank accounts that are subject to unofficial capital controls, and “fresh funds” to designate foreign currency cash and foreign currency bank accounts that are free from capital controls (as they are sourced from foreign currency cash and/or from incoming transfers from abroad) due to the difference in the perceived real economic value.

Several exchange rates have emerged since the last quarter of 2019 that vary significantly from each other and from the official exchange rate: parallel exchange markets with high volatility, recently issued circulars by the Central Bank of Lebanon and estimation exchange rates detailed in the Plan, in addition to a wide range of exchange rates adopted for commercial transactions currently undertaken in the Lebanese territory. These separate audited financial statements for fiscal year 2021-2022 do not include adjustments from any future change in the official exchange rate.

According to ASC 830-20-30-3, and in the presence of multiple exchange rates, it is required that a foreign currency transaction be measured at the applicable rate at which a particular transaction could be settled on the transaction date. The university ensured full compliance with the requirements of the above code and the separate audit financial statements for the previous and current fiscal years were issued with an unqualified opinion.

The university’s tuition revenue is regularly billed in US Dollars and students had the option to settle in Lebanese Pounds. During February 2021, in which month the billing of the spring semester occurred, the university increased the rate to LBP 3,900 per $1 after the Central Bank of Lebanon issued Circular 151 allowing depositors to withdraw a portion of their deposits at the rate of LBP 3,900 per $1 (previously at LBP 1,515 per $1).

In May 2021, the Central Bank of Lebanon established another new exchange platform known as “Sayrafa” to provide foreign currency for imports at an exchange rate of LBP 12,000 per $1. “Sayrafa” rate steadily increased reaching LBP 27,200 per $1 at the closing date of fiscal year ended August 31, 2022.

The persisting economic crisis in Lebanon, the unavailability of financing and the imposition of unofficial capital controls together with the current instability and the business might lead to an escalated deterioration in the university’s future financial performance in Lebanon. The extent and duration of such impacts remain uncertain and dependent on future developments. Given the ongoing economic uncertainty, a reliable short-term estimate of the impact on the financial position of the university cannot be realistically predicted.

During fiscal year 2021-22, LAU applied the “Sayrafa” rate to reflect the US$ value of transactions originating in LBP currency. Moreover, during fall term 2021, LAU continued to accept settlement of outstanding tuition fees, originally billed in US Dollars, in Lebanese Pounds at the rate of LBP 3,900 per $1, with the option to pay partially in bank dollars. Starting spring 2022, the university limited the payment in bank dollars to a maximum of 35 percent and the remainder in fresh Lebanese Pounds. Conversion of bank dollars to Lebanese Pounds was made at the new banking platform rate of LBP 8,000 per $1 which came into effect in December 2021 replacing the previous banking platform rate of LBP 3,900 per $1.

During the first half of fiscal year 2021-22, payment transfers within Lebanon continued without restrictions which allowed for normal local payments and collections of receivables that are mainly generated from tuition fees in Lebanon. This, however, partially changed effective the second half of the year when more restrictions on the Lebanese Pound and bank dollars currencies circulation were enforced by odd and uncontrolled market conditions.

Starting fall term 2022, LAU shifted its tuition to full dollarization. Its decision was backed by a generous financial aid package aimed at maintaining minimum student attrition. The strategy adopted by the university came to fruition as evidenced by nil attrition during that term. This resulting outcome provided good assurances about the institution’s ability to maintain reliable financial and operational sustainability without the need to have recourse to outside funding. Firmer assurances about continuing sustainability stand, however, dubious and highly dependent on the political and economic uncertainties in the country.

The management is closely monitoring the environment in which the university operates, including key indicators within its business, in order to minimize risks facing the institution and its future performance.

As an integral part of a complex national fabric, the university stood firmly by its mission to educate and serve, undertaking to help the students get an education irrespective of their financial means. This commitment was favorably perceived and welcomed by a community in desperate need of support.

LAU’s commitment to excellence and, with it, its students and community, stands unrivaled. More than half the university’s student population benefits from financial aid. In addition, the university has made a substantial investment in academics manifested by an increase in the number of full-time faculty and physicians.

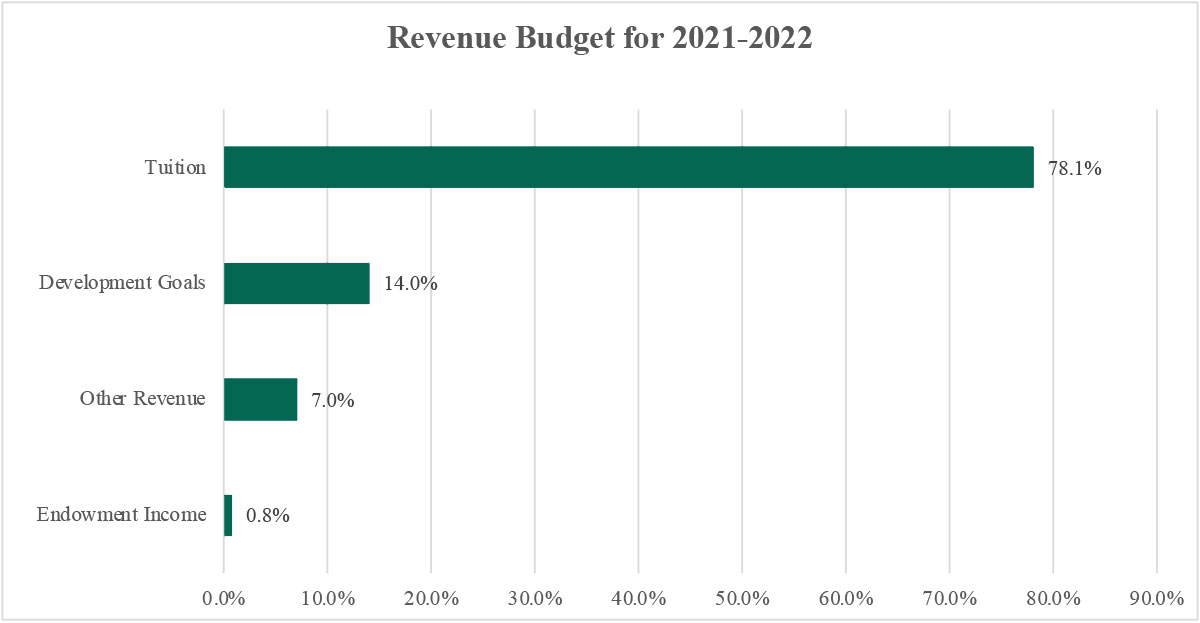

LAU’s operating budget for AY2021-2022 was around $193.6 million. This budget represents a landmark given the restrictive economic conditions prevailing in Lebanon.

| Revenue Budget for 2021-2022 | US Dollars |

|---|---|

| Tuition |

151,271,55778.1% |

| Development Goals |

27,191,79814% |

| Other Revenue |

13,632,4217% |

| Endowment Income |

1,500,0000.8% |

| Total |

193,595,776 |

The Overall Picture

Despite the challenges faced, LAU has maintained a solid level of financial sustainability. The total assets of the university amounted to $1.16 billion, indicating the significant value of the resources and investments held by the institution. Net assets, which represent the difference between total assets and total liabilities, settled at $1.13 billion. This indicates the university’s accumulated wealth and resources that are available for future operations and investments. Overall, the university’s solid financial sustainability is a positive indicator, demonstrating its ability to navigate through challenging times while maintaining a stable financial standing. This provides a foundation for continued growth, development, and the pursuit of its academic and institutional objectives.

Pressure on enrollment is increasing considering the economic conditions and competition. Nonetheless, LAU is managing to keep enrollment at healthy levels. This is costing the university more investment in aid given the prevailing circumstances. However, remarkable efforts are being exerted by all constituents to help sustain a healthy operation.

Investment in subsidiaries was $182.2 million as of August 31, 2022, up by $35.7 million compared to last year. The fair market value of the property and assets of the hospitals returned a positive excess over the amounts already invested by the university. This confirms that our investment is not impaired.

LAU’s investments, mainly made up of endowments, witnessed a drop and closed at $591.6 million as of August 31, 2022. Looking forward, some risks will be rewarded, and well-structured portfolios can achieve realistic investment goals. LAU’s Investment Committee, Investment Office and consultants continue to focus on winning strategies while monitoring the Endowment Portfolio, assessing market conditions, and building a strategic asset allocation mix and robust manager-selection processes.

Undergraduate financial aid reached unprecedented heights during fiscal year ended August 31, 2022. More than half the undergraduate students benefit from financial aid. This number is expected to reach significantly higher levels during the next academic year in line with the new strategy adopted by the university and the fast-changing economic conditions.

Total expenses, excluding financial aid, dropped by around 2.0 percent compared to the prior fiscal year in line with the university’s cost-cutting plan. In addition to the above, operating expenses displayed continuing efficiency and effectiveness in the allocation of resources, sparing more funds for financial aid.

| Expense Budget for 2020-2021 | US Dollars |

|---|---|

| Financial Aid |

78,851,82440.7% |

| Teaching Compensation |

38,894,15120.1% |

| Non-Teaching Compensation |

25,837,58713.3% |

| Depreciation |

14,474,8067.5% |

| Contracted Services |

11,765,8246.1% |

| Other Projects Budget |

4,542,6532.3% |

| Utilities |

4,112,6922.1% |

| Other Expenses |

3,995,7422.1% |

| SPIII |

2,935,0001.5% |

| Supplies |

2,623,1931.4% |

| Books & Electronic Resources |

2,132,4341.1% |

| Contingency & Transfers |

1,000,0000.5% |

| Travel & Conferences |

953,3300.5% |

| Communication |

732,7550.4% |

| Entertainment & Public Relations |

383,0280.2% |

| Transportation |

360,7570.2% |

| Total |

193,595,776 |

Endowment

Endowments play a critical role in providing essential resources for future investments and expenditures at universities like LAU. They serve as permanent, self-sustaining sources of funding that foster dynamic and long-term stability, enabling the university to thrive.

Through its endowments, LAU is able to rely on a safety net to address unforeseen issues and access additional resources to support vital areas of the university’s development, such as scholarships and financial aid, campus expansions, and various operational costs. These endowments provide a constant source of support, ensuring the university’s ability to adapt and grow in a sustainable manner.

The significance of endowments is particularly evident during challenging times, as seen in the past fiscal year with Lebanon’s ongoing crises, the COVID-19 pandemic, and the August 2020 explosion. These events underscore the importance of having endowments as a means to mitigate the financial impact on the university and emphasize the need for continuous funding to maintain their effectiveness.

At LAU, the endowment is divided into three different funds: general, schools and financial aid. Given the pressing economic challenges faced by students and their families in the region, financial aid is a particularly critical focus for support within LAU’s endowment structure. Donations made to these funds have a lasting impact on the university’s future and provide invaluable opportunities for countless students each year.

During fiscal year 2021-2022, LAU’s investment portfolio, which encompasses its endowments, outperformed market indices. Looking ahead, well-rewarded risks and well-structured portfolios are expected to contribute to achieving realistic investment goals. This highlights the importance of sound investment strategies in maximizing the returns generated by the endowment funds.

To secure a financially stable future for the university, the Office of Development at LAU remains committed to seeking endowment gifts. They actively engage with donors and stakeholders to encourage contributions to the university’s endowment funds. These gifts provide crucial resources that support the institution’s long-term financial sustainability and help fund various initiatives and programs.

Meanwhile, the investment committee, finance and investment offices, and investment consultants work together to develop winning strategies for the university’s endowment portfolio. They closely monitor market conditions, assess investment opportunities and analyze risks to make informed investment decisions. Their focus is on building a strategic asset allocation mix that aligns with the university’s objectives and risk tolerance.

Additionally, robust manager selection processes are implemented to ensure that the university’s endowment funds are managed by capable and experienced investment professionals. This includes evaluating potential investment managers, conducting due diligence, and regularly monitoring their performance.

By adopting a proactive and diligent approach to managing the endowment portfolio, LAU aims to maximize returns and preserve the long-term value of the funds. This strategic approach helps ensure the financial health and stability of the university, enabling it to continue providing quality education and support to its students and community.