Living Wage

The university adheres to the legal framework established by Lebanese labor law, which mandates that wages meet or exceed the official minimum wage. Additionally, the Personnel Policy Staff Section (2022) explicitly states that wages paid to staff members must be in Lebanese currency and align with the government-defined minimum wage. This ensures that compensation not only meets legal requirements but also addresses essential needs, promoting economic sustainability and social responsibility.

During Lebanon’s financial crisis, the university demonstrated resilience by continuing to support its faculty and staff through various measures, including salary adjustments, partial reinstatement of benefits, and improvements in healthcare packages. These efforts were complemented by a structured approach to compensation, designed to uphold dignity, fairness, and operational efficiency.

In summary, the university actively fulfills its obligation to pay a living wage, taking into account legal requirements, economic conditions, and its commitment to the well-being of its workforce.

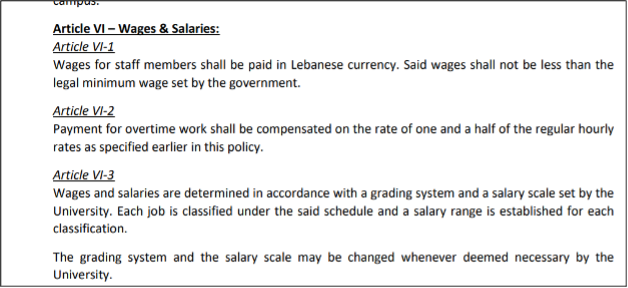

Personnel Policy Staff (2022):

A key principle is that the university pays all employees at or above a determined living wage, reflecting LAU’s commitment to economic sustainability and social responsibility. According to the updated the PERSONNEL POLICY STAFF SECTION (2022), Article VI – Wages & Salaries stipulates in Article VI-1: Wages for staff members shall be paid in Lebanese currency. Said wages shall not be less than the legal minimum wage set by the government. (https://www.lau.edu.lb/about/policies/personnel_policy_staff_section.pdf).

Extract from the PERSONNEL POLICY STAFF SECTION.

Lebanese Labor Law

The Lebanese Labor Law stipulates the following:

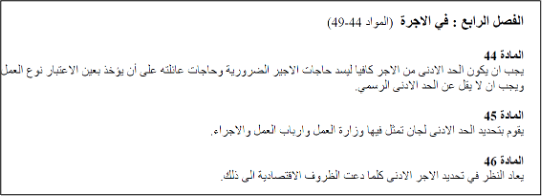

Chapter Four: On Wages (Articles 44-49)

Article 44

The minimum wage must be sufficient to meet the essential needs of the worker and their family, taking into consideration the type of work. It must not be less than the official minimum wage.

Article 45

The determination of the minimum wage is carried out by committees that include representatives from the Ministry of Labor, employers, and workers.

Article 46

The minimum wage is reviewed and redefined whenever economic circumstances necessitate it.

Extract from the Lebanese Labor Law regarding wages

Salaries adjustments after the financial meltdown

Moreover, throughout the recent financial meltdown in Lebanon that started in 2019, the University leadership continued to support the academic process to ensure that the University employs needed administrators, faculty and staff to achieve its mission. After freezing staff hires for two years, the University resumed normal recruitment activities in 2023. The University also developed various retention measures that aim at retaining faculty and staff including additional salary dollarization, improvement in the health package, and partial reinstatement for benefits such as dependents’ schooling (https://www.lau.edu.lb/files/institutional-self-study-2024-comprehensive-evaluation.pdf).

On one side, setting the salary scale of employees is the responsibility of the HR department, and it should do so in a way that maintains dignity and fairness. This commitment presupposes adherence to set salary scales that correspond to the wages employees receive, proportionate to their roles, ranks, and academic qualifications. It considers, with much care, the rank an employee falls into and the academic degrees held while setting his or her compensation at a proper and reasonable level, appreciative of the professional and academic service that the faculty and staff conduct.

It also strives to ensure that the work environment will result in high performance of employees and operational efficiency across boards. The better job satisfaction and productivity of university staff through effective compensation and support will lead to improved well-being among employees and contribute to ensuring the best outcomes for institutional performance and reputation. A structured approach to compensation is one which balances off the needs of the workforce with that of the greater university community rather equitably.

More activities, undertaken by LAU, related to salaries adjustments could be found below:

Wage Dynamics Post–Covid-19 and Wage-Price Spiral Risks

The Department of Economics at LAU is hosting a seminar titled: “Wage Dynamics Post–Covid-19 and Wage-Price Spiral Risks” by Dr. Silvia Albrizio, Economist at IMF.

Inflation has reached a 40-year high in some economies. Although wage growth has generally stayed below inflation so far, some observers warn that prices and wages could start feeding off each other, with wage and price inflation ratcheting up in a sustained wage-price spiral. This World Economic Outlook chapter examines past and recent wage dynamics and sheds light on prospects. Similar historical episodes were not followed by wage-price spirals on average. Analysis highlights that more backward-looking expectations require stronger and more frontloaded monetary tightening to reduce risks of inflation de-anchoring. Risks of a sustained wage-price spiral appear limited since underlying inflation shocks come from outside the labor market and monetary policy is tightening aggressively.

The Role of Social Spending and Financial Inclusion in Fostering Inclusive Economic Growth in the MENA Region

A seminar held by AKSOB’s Department of Economics and the International Monetary Fund invited experts to analyze economic challenges in the MENA region and advocate for inclusive growth.

Numerous challenges have impeded achieving the eighth Sustainable Development Goal (SDG) on decent work and economic growth.

The impact of the COVID-19 pandemic on the cost of living, monetary policies and mounting debts in developing nations has proven to be a setback to the growth of the economy globally.

To that end, in a seminar titled Promoting Inclusive Growth in the MENA Region: The Role of Social Spending and Financial Inclusion, the Department of Economics at the Adnan Kassar School of Business, in collaboration with the International Monetary Fund (IMF) assembled experts and economists to examine the economic trials facing the Middle East and North Africa (MENA) region.

Chair of the Department of Economics at LAU, Associate Professor of Economics Ali Fakih was joined by Associate Professor of Economics at AUB Leila Dagher and President of the Lebanese Business Leaders Association Nicolas Boukather in the seminar moderated by Assistant Professor of Economics at LAU Hassan Sherry.

The department invited IMF’s Senior Economist Adolfo Barajas, Deputy Division Chief Anastasia Guscina and Mauritania Representative Anta Ndoye to discuss its approach in the MENA region, underscoring the urgency to yield high returns to growth by classifying social spending.

Together, the scholars and IMF representatives explored strategies to foster sustainable and inclusive economic growth through the lens of a recent IMF book on inclusive growth, highlighting the relationship between social spending, financial inclusion and inclusive growth in the region.

During the seminar, Dr. Fakih expounded on the critical role of the aforementioned aspects in empowering individuals and marginalized groups, reducing inequality – mainly in rural areas – and driving sustainable development.

As the participants engaged in discussion, they drew attention to how the “book was part of a series of events leading up to the annual IMF and World Bank meetings in Morocco,” said Frederico Lima, IMF resident representative for Lebanon. “The main focus of these meetings and events is about inclusive growth and how to generate that in the MENA region, especially in Lebanon, as it faces dire social, political and financial challenges.”

Dr. Sherry noted that recent global events, such as the 2008 financial crisis and the COVID-19 pandemic, had prompted the IMF to reconsider its approach to economic policies. “This book perhaps indicates some type of departure from traditional practices,” he said, emphasizing the importance of social protection systems, financial inclusion and addressing climate change.

The IMF team shared insights into the indispensable role of social spending and financial inclusion in economic development.

“Social spending can be thought of as a key policy that the governments must address in promoting economic equities and inclusive growth through prioritizing spending with the highest returns to growth,” said Dr. Guscina. Hence, IMF programs can stipulate a minimum floor of social spending for each country to ensure that the adjustment is socially sustainable and inclusive growth is protected.

Regarding financial inclusion, noted Dr. Barajas, decades of empirical analysis have shown that greater access to types of financial services has a measurable impact at the micro level on households and firms.

With a Q&A drawing the seminar to a close, Dr. Fakih and Dr. Dagher addressed the IMF’s role in creating fiscal space for social spending and improving access to finance for small legal enterprises in the MENA region.

“Financial inclusion over the last two or three years has decreased substantially, so much so that we are facing difficulty funding essential goods for services such as education,” said Dr. Fakih. “It is significant to reform the current social spending in order to come up with different strategies to fund essential services.”

The drawback in establishing a sustainable and inclusive social protection program in Lebanon, noted Dr. Dagher, is the lack of a comprehensive digital social registry and integrated database to ensure inclusivity.

“A large-scale digital social registry, a comprehensive, integrated registry that includes both Lebanese and non-Lebanese formal and informal sectors is a prerequisite for an inclusive social protection scheme,” she said.

For Dr. Boukather, the need for effective leadership and communication to regain trust in Lebanon’s economic ecosystem makes the IMF report and its potential to restore confidence from international partners all the more urgent.

Invitations to apply to the 2023 IMF Youth Fellowship Program were extended to participants so that they would get further opportunities to engage in akin discussions and workshops, as well as attend the World Bank and IMF annual meetings in Marrakesh taking place in October.

Assessing the Progress of Arab States Toward the Sustainable Development Goals: The Role of Social Expenditures

A seminar held by AKSOB’s Department of Economics brings to light the report on Social Expenditure Monitor for Arab States, jointly produced by ESCWA, the UNDP and UNICEF.

While countries worldwide strive to meet the United Nations Sustainable Development Goals (SDGs) that call for building economic growth, addressing social needs equitably and preserving our planet, the Arab States lag behind. To redress the situation, they would need to effectively rebalance their priorities, focus on social expenditure, and improve their public financial management.

How to go about these reforms was the topic of a seminar organized by the Department of Economics at the Adnan Kassar School of Business (AKSOB) on March 29 – as part of its Economics and Public Policy Seminar Series – which discussed the Social Expenditure Monitor for Arab States report released by The Economic and Social Commission for Western Asia (ESCWA).

The Department of Economics invited ESCWA’s Senior Economic Affairs Officer, report lead author and coordinator Niranjan Sarangi, Research Assistant Dana Hamdan, and Economic Affairs Officer Jan Gaska to present the report and discuss its main findings and recommendations. They were joined by Advisor to the United Nations Development Programme (UNDP) Regional Bureau for Arab States Rania Uwaydah.

At the seminar, experts discussed the latest developments and trends in social policy spending in the Arab region, as well as the obstacles and prospects for achieving the SDGs.

“Despite significant progress made by some Arab countries in social development and spending, persistent poverty, inequality, and social exclusion remain a challenge for others in the region,” noted Associate Professor and the department’s Chairperson Ali Fakih. “Against this backdrop, social policy spending has become a critical tool for enhancing social protection, promoting human capital, enhancing productivity and growth, upholding human rights, and reducing poverty and inequality.”

“The Social Expenditure Monitor report stands as a pioneering assessment of social spending in the Arab region which is intended to galvanize progress across the SDGs,” noted Dr. Sarangi. “Social spending is a pillar of the wellbeing of individuals and society, an engine of progress in the fields of education and health, and a way to protect vulnerable groups. The report’s recommendations support Arab countries in devising strong budgets and in making expenditure choices more equitable, efficient and effective to ensure that no one is left behind,” he highlighted.

Data on social expenditure by country is provided as a guideline for needed reforms. It can be used by each Arab State and its decision-makers to develop reliable budgets and formulate more equitable, efficient and sustainable fiscal policies. The study on Lebanon is among those that have already been completed, based on publicly available budgets.

An analysis of the equity, efficiency, and effectiveness of fiscal policy and budgeting in the Arab region revealed that the average public social expenditure of Arab States on health, education, and social protection, as a share of GDP, is lower than the world average. This is concerning for achieving the SDGs and ensuring inclusive and sustainable growth.

The Social Expenditure Monitor report proposes a new approach for monitoring social expenditures across seven dimensions aligned with the SDGs: Education; health and nutrition; housing, connectivity and community amenities; labor market interventions and employment generation; social protection, subsidies and support to farms; arts, culture and sports; and environmental protection.

Through detailed data and analysis, the report aims to optimize links between expenditure choices and macroeconomic objectives, provide a basis for better statistics, and strengthen advocacy for much-needed fiscal policy reforms to meet various objectives crucial for macroeconomic and social stability.

Arab countries would have to build their budgets by rebalancing priorities toward improved public financial management. An 11-point agenda in the report reinforces these findings and offers suggestions for increasing social spending while ensuring economic sustainability.

In increasing social spending and fiscal sustainability, a certain number of policy consequences or implications must be considered, prominent among them being public financial management (PFM).

A solid PFM system, explained Uwaydah, guarantees that governmental policies are properly executed and that associated development objectives are accomplished. Ensuring that the funds received actually reach their destination and policy decisions are implemented to achieve the relevant development goals is critical, especially at a time of considerable resource constraints.

The Social Expenditure Monitor for Arab States seminar provided a comprehensive evaluation of the social policy expenditures in the Arab region to enhance their performance toward the SDGs. The recommendations in the report are intended to help Arab nations develop reliable budgets and make more equitable, efficient, and effective expenditure decisions to ensure inclusivity and sustainable development. They further highlight the need to invest in human capital in order to support future development.

The discussion was an opportunity for students to learn about experts’ perspectives and the issues related to the impact of social spending in the Arab World. A cooperative discussion following the main presentations, said Dr. Fakih, “certainly played an important role in improving their networking and communication skills as well as renewing their confidence and motivation to enhance their knowledge in the specific areas addressed.”